22+ Illinois Wage Calculator

Web Illinois Income Tax Calculator 2021. Rates are based on several factors including your industry and the amount of previous.

Pdf Minimum Wages Minimum Labour Costs And The Tax Treatment Of Low Wage Employment

Web We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

. If you make 70000 a year living in the region of Illinois USA you will be taxed 11737. Just enter the wages tax withholdings and other information. The 2022 Illinois State minimum wage rate is 1200 per hour Illinois vs.

Web Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Living Wage Calculation for Illinois.

Give our Illinois payroll calculator a. Web The second algorithm of this hourly wage calculator uses the following equations. This calculator is a tool to estimate how much federal income.

Although you might be tempted to take an employees earnings and multiply by 495 to. Your average tax rate is 1198 and your. Web As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

Web Illinois Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state. The Illinois Paycheck Calculator uses Illinois tax. The tool helps individuals communities and.

This is a projection based on information you provide. Web Personal Income Tax in Illinois. Web Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right.

Web In Illinois tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as well as any tip credits claimed by their. Web The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C.

I recommend checking out our Payroll Tax Compliance. Personal income tax in Illinois is a flat 495 for 2022. Federal Minimum Wage Federal Minimum Wage per hour Illinois State Minimum.

Web The feature to calculate Illinois Minimum Wage Credit in QuickBooks is not available DS61938. Web 2022 Federal Tax Withholding Calculator. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Illinois Paycheck Calculator Adp

44 Expense Sheet Templates In Pdf

Democracy Without Choice Citizens Perceptions Of Government Autonomy During The Eurozone Crisis Ruiz Rufino 2017 European Journal Of Political Research Wiley Online Library

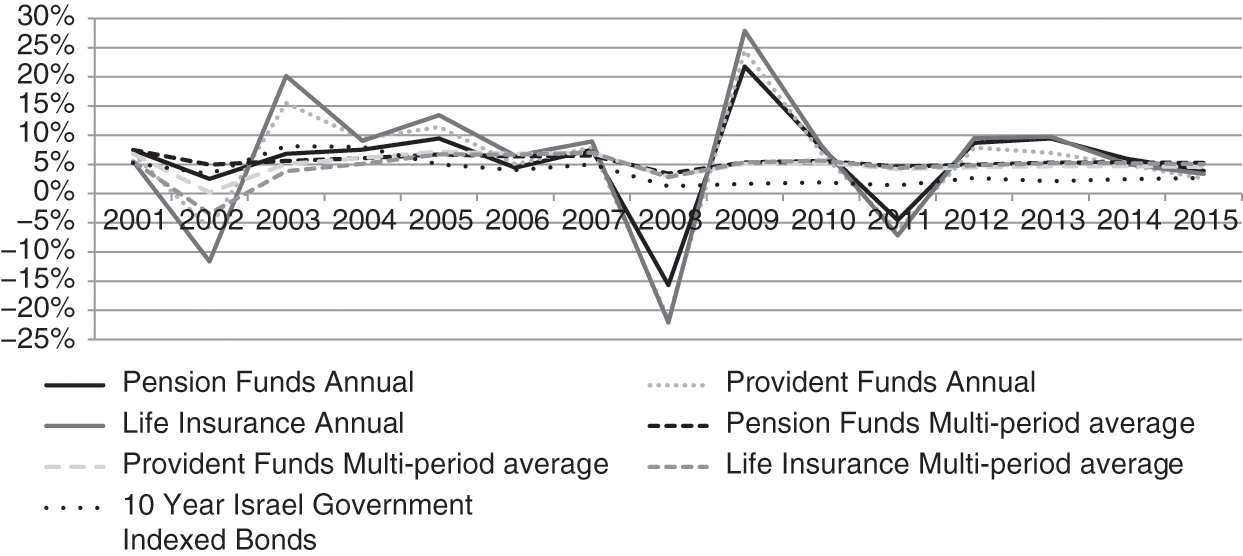

The Reforms In The Israeli Pension System 1995 2015 Chapter 8 The Israeli Economy 1995 2017

Illinois Salary Example For 105 000 00 In 2023 Icalcu

Partes Compresor Ga 30 Nuevo Pdf Pdf

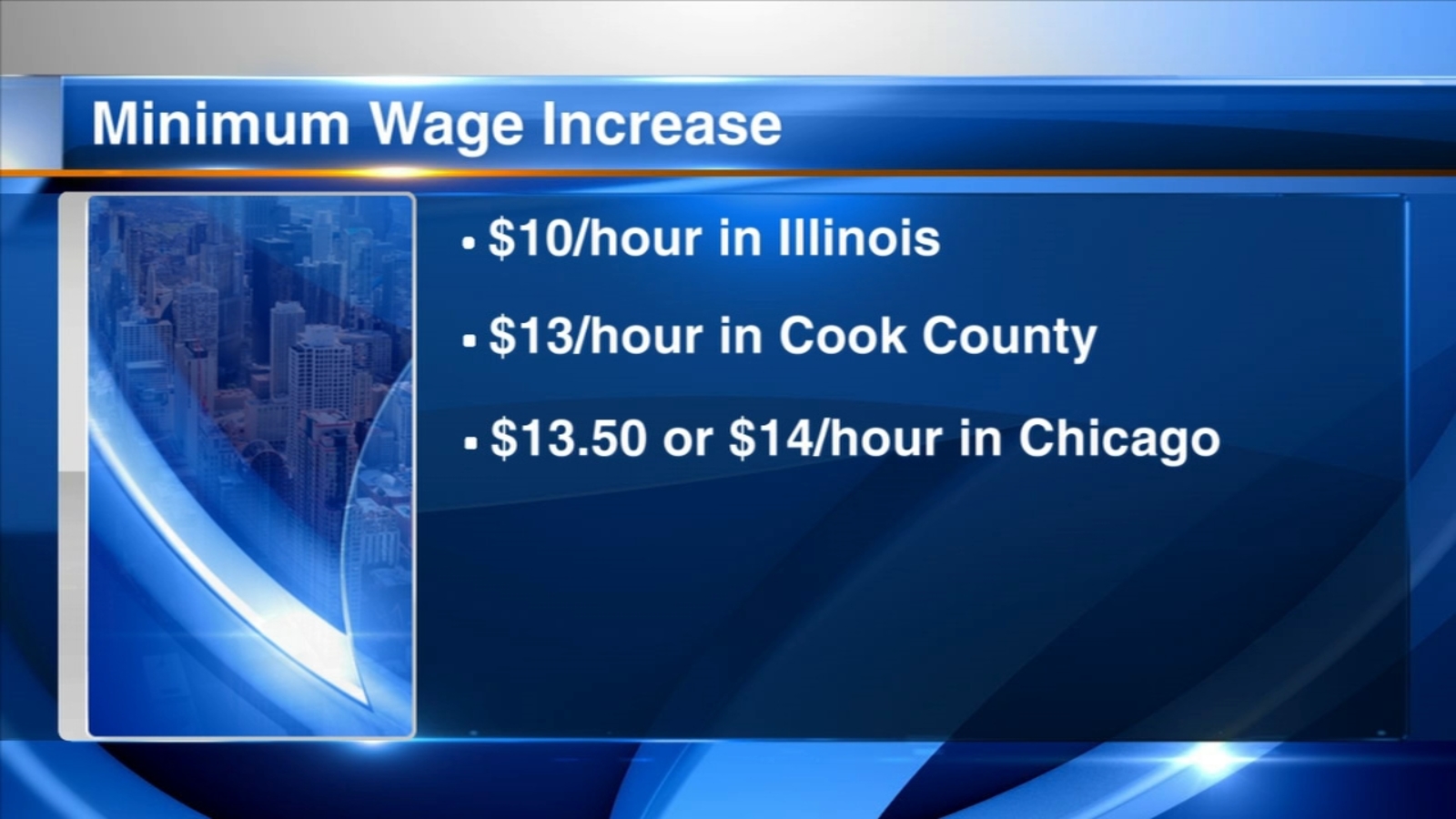

Minimum Wage In Illinois Cook County And Chicago Increases Take Effect July 1 Abc7 Chicago

Chicago Latino Network Enjoy The Weekend

Illinois Paycheck Calculator Tax Year 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee

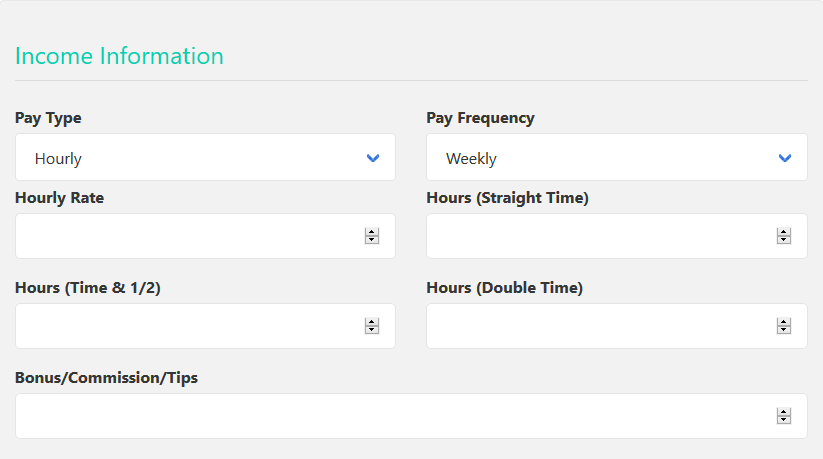

Video Guide Esmart Paycheck

Illinois Paycheck Calculator Adp

Leather Trades Apartments 1600 Locust Street St Louis Mo Rentcafe

How Much Does Dohn Community High School Pay In 2023 11 Salaries Glassdoor

Payroll Tax Calculator Screen

The Reforms In The Israeli Pension System 1995 2015 Chapter 8 The Israeli Economy 1995 2017

Pdf Vault Guide Top Zoe Zhao Academia Edu